UNDERSTANDING HOW TO HANDLE PRE-ADVERSE AND ADVERSE ACTIONS

The background check came back with a record on it. Your team has reviewed the report, reviewed your policy and have decided they do not meet your requirements. Now what? You will need to take Pre-Adverse Action, and then potentially Adverse Action. One Source has given a quick tip in the past about how to access these templates, but what does that mean? Let’s take a closer look at how to handle pre-adverse & adverse actions.

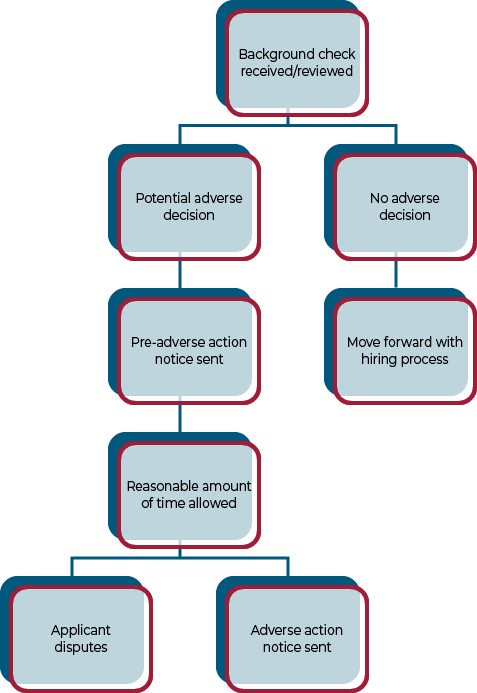

Adverse action is governed by the Fair Credit Reporting Act (FCRA) and employers must follow the requirements. You can rest assured you are in compliance by following the steps of pre-adverse and adverse action by using the simple graphic below:

It is essential the employer provides the applicant with the pre-adverse action letter, a copy of their report and a copy of the summary of FCRA rights. If the applicant does dispute, One Source will notify you and assist you through the process. If the applicant does not dispute, we suggest you wait a reasonable amount of time before sending the adverse action letter. If the dispute is returned, you as the employer can either continue with the adverse action or provide the applicant the position that was held for them.

The dispute process is part of the FCRA. Consumer reporting agencies receive alerts of discrepancies occasionally reported through human error or at the court level. With that said, One Source proudly boasts a 99.95% accuracy rate. When an applicant disputes a report, we have the opportunity to conduct additional research on it. An applicant has the right to dispute their report here: https://www.onesourcebackground.com/applicant-disputes/

Please note this information falls in line with the FCRA. City, county or state laws may apply to you as well.

Don’t forget to review the quick tip for pre-adverse and adverse action. One Source loves to help you walk through the process. Contact us today!

Disclaimer: When procuring reports from a background check company also referred to as a Consumer Reporting Agency (CRA), know how to proceed if you decide to take adverse action against an applicant based on information the CRA provided. This specific process is written for the permissible purpose of (pre) employment. Other permissible purposes have similar processes but may not require the pre-adverse step.